Buying a home is a big deal, and figuring out the right loan can feel like a maze. There are heaps of options out there for Home Loans in Australia, and understanding them is key to making sure you get a loan that actually suits you. We’ll break down the common types, what makes them different, and how to pick the one that fits your situation best. It’s not as complicated as it sounds, really.

Key Takeaways

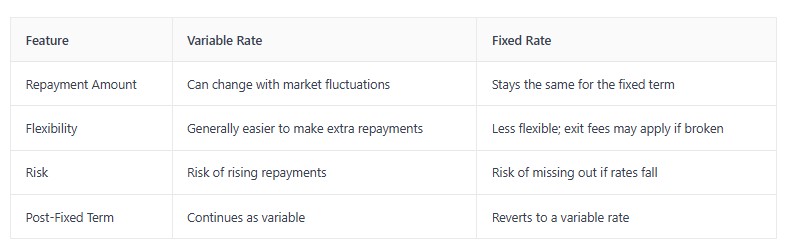

- Variable rate loans can change with the market, while fixed rate loans offer stable payments for a set time. After the fixed period, they usually switch to a variable rate.

- Split loans combine both fixed and variable rates, giving you a bit of security and a bit of flexibility.

- Principal and interest repayments gradually pay down both the loan amount and the interest, helping you build equity.

- Interest-only repayments are usually lower initially and can be useful for investment properties, but you’ll pay more interest overall.

- Owner-occupier loans are for when you live in the home, and investor loans are for properties you plan to rent out. Interest rates can vary between these.

Why Understanding Home Loan Types Matters

Choosing the right home loan is a big decision, and it’s not just about the interest rate. The type of loan you select can significantly impact your financial journey, affecting everything from your monthly budget to your long-term wealth building. Understanding the different structures and features available is key to making a choice that aligns with your personal circumstances and future goals.

Think about it this way: not everyone needs the same thing from a loan. Someone buying their first home might prioritise lower initial repayments, while an investor might look for features that offer tax advantages. Even your personal comfort level with risk plays a role. Do you prefer the predictability of fixed payments, or are you comfortable with the possibility of your rate changing?

Here are a few common considerations that highlight why this knowledge is so important:

- Repayment Structure: Will you pay off the loan principal and interest from the start, or opt for an interest-only period? This choice affects your immediate cash flow and the total interest paid over the life of the loan.

- Interest Rate Type: A fixed rate offers certainty, shielding you from rate rises, but might mean missing out if rates fall. A variable rate offers flexibility and potential savings if rates drop, but carries the risk of increases.

- Loan Features: Things like offset accounts or redraw facilities can help you save on interest or access extra funds, but they aren’t available with all loan types.

Making an informed decision upfront can save you considerable money and stress down the track. It’s about finding a loan that works for you, not against you.

Getting this right from the beginning means you’re setting yourself up for a smoother home ownership experience. It’s worth taking the time to explore your options.

Key Features of Home Loans in Australia

When you’re looking at home loans, it’s not just about the amount you can borrow. Several key features will shape your borrowing experience and the total cost over time. Understanding these elements helps you make a more informed decision.

Interest Rates: Fixed vs. Variable

This is one of the most significant choices you’ll make. A variable interest rate can go up or down based on market conditions and decisions by the Reserve Bank of Australia (RBA). This means your monthly repayments could change.

On the other hand, a fixed interest rate stays the same for a set period, usually between one and five years. This offers certainty in your budget, as your repayment amount won’t fluctuate during that fixed term. However, once the fixed period ends, the loan typically reverts to a variable rate, and you might face higher repayments if interest rates have risen.

Loan Structures: Principal and Interest vs. Interest Only

Your loan structure dictates how you repay the money you’ve borrowed.

- Principal and Interest (P&I): This is the most common structure. With each repayment, you pay down both the amount you borrowed (the principal) and the interest charged on that loan. Over time, your loan balance decreases.

- Interest Only: For a set period, you only pay the interest charged on the loan. This results in lower regular repayments during that initial phase. However, the principal amount remains unchanged, and once the interest-only period ends, your repayments will increase significantly as you then start repaying the principal plus interest.

Interest-only loans are often used by property investors to manage cash flow, but owner-occupiers might consider them for specific financial planning reasons. It’s important to understand the long-term impact on your loan balance.

Loan Terms and Repayment Schedules

The loan term is the total length of time you have to repay your home loan, typically ranging from 15 to 30 years. A longer loan term means lower regular repayments, but you’ll pay more interest overall. A shorter term means higher repayments but less interest paid over the life of the loan.

Repayment schedules usually involve monthly payments, but some lenders may offer fortnightly or weekly options. Making more frequent repayments, even if they are smaller amounts, can sometimes help you pay off your loan faster and reduce the total interest paid.

Common Types of Home Loans Available

When you’re looking to buy a home in Australia, you’ll find there are several types of home loans available. It’s not just about the interest rate; the structure of the loan and the features offered can significantly impact your financial journey. Understanding these differences is key to selecting a loan that aligns with your personal circumstances and future goals.

Standard Variable Rate Home Loans

These are perhaps the most common type of home loan. With a variable rate loan, the interest rate you pay can go up or down over the life of the loan, influenced by changes in the market. This means your regular repayment amount could change. If rates fall, your minimum repayment might decrease, but it won’t automatically reduce if rates rise – you’ll need to adjust your payments accordingly if you want to keep your repayment schedule on track.

Fixed Rate Home Loans

If you prefer predictability, a fixed rate home loan might be suitable. For a set period, typically between one and five years, your interest rate remains the same. This offers certainty for your budget, as your repayments won’t change during that fixed term. Once the fixed period ends, you can usually choose to fix the rate again or switch to a variable rate.

Interest-Only Home Loans

With an interest-only home loan, for a specified period, you only pay the interest charged on the loan amount. This results in lower regular repayments compared to a principal and interest loan. However, it’s important to remember that during the interest-only phase, you are not reducing the actual amount you borrowed. After this period, your repayments will typically increase significantly as they will then include both principal and interest.

Offset Accounts and Redraw Facilities

Many home loans come with additional features that can help you manage your finances. An offset account is a transaction account linked to your home loan. Any money held in this account is offset against your loan balance, reducing the amount of interest you pay. For example, if you have a $400,000 loan and $20,000 in your offset account, you’ll only be charged interest on $380,000. Redraw facilities allow you to redraw any extra repayments you’ve made on your loan, providing access to funds if needed. These features are generally not available on fixed rate loans.

It’s worth noting that if you’re unsure about which loan type best suits your situation, speaking with a mortgage broker can be very beneficial. They have a broad knowledge of the market and can help you find options, including potentially easier approval home loans if your circumstances are unique.

Choosing the Right Home Loan for Your Needs

Selecting the correct home loan is a big decision, and it really comes down to what you’re trying to achieve with your finances and your property. Think about your current situation and what you expect in the future. Are you looking for stability in your repayments, or do you want the flexibility to make extra payments without penalty?

Your personal circumstances and financial goals should be the primary drivers of your choice.

Here’s a breakdown to help you consider your options:

- Owner-Occupier vs. Investor Loans: If you’re buying a place to live in, you’ll likely need an owner-occupier loan. If you’re buying property to rent out, an investor loan is the way to go. Investor loans often have different features and interest rates.

- Repayment Type: Most people opt for a principal and interest loan, where you pay back both the loan amount and the interest over time. An interest-only loan might suit some investors or those expecting a significant income increase soon, as it means lower initial repayments, but you’ll still owe the full loan amount at the end of the term.

- Interest Rate Type: A variable rate loan means your interest rate can go up or down with market changes, affecting your repayments. A fixed rate loan locks in your interest rate for a set period, offering certainty but less flexibility. A split loan allows you to have a portion of your loan on a fixed rate and another on a variable rate, giving you a bit of both worlds.

Consider how long you plan to stay in the property and your tolerance for risk. If you value predictability above all else, a fixed rate might be appealing. If you’re comfortable with potential fluctuations and want the ability to pay down your loan faster, a variable rate could be better. Some people even split their loan, fixing part of it for certainty and keeping the other part variable for flexibility.

It’s not just about the interest rate; features like offset accounts, redraw facilities, and loan flexibility can significantly impact how much interest you pay over the life of the loan and how easily you can manage your repayments.

Next Steps: Applying for a Home Loan

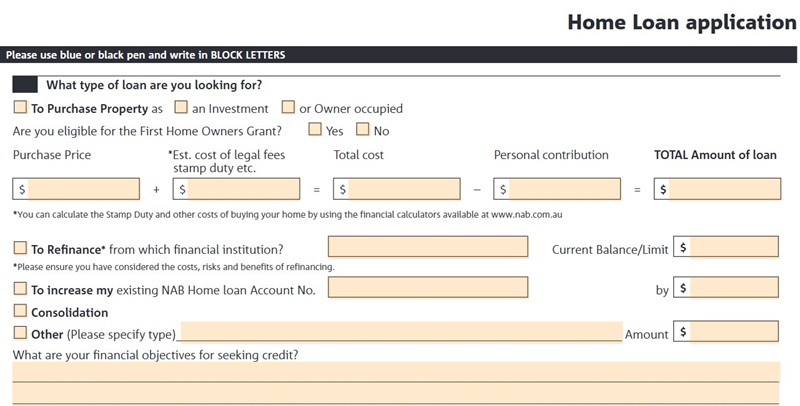

Once you’ve got a good handle on the different home loan options available and have a clearer idea of what suits your financial situation and property goals, the next logical step is to begin the application process. It might seem a bit daunting, but breaking it down makes it much more manageable.

The key is preparation and understanding what lenders will be looking for.

Here’s a general outline of what you can expect:

- Gather Your Documents: Lenders will need to verify your identity, income, employment, assets, and liabilities. This typically includes payslips, bank statements, tax returns, identification (like a driver’s licence or passport), and details of any existing debts.

- Get Pre-Approval: Before you start seriously house hunting, it’s wise to get pre-approval. This involves a lender assessing your financial situation to determine how much they’re likely to lend you. It gives you a realistic budget and makes your offer stronger when you find a property.

- Choose Your Lender and Loan Product: Based on your research and pre-approval, select the lender and specific home loan product that best fits your needs. Don’t be afraid to compare offers from different banks and non-bank lenders.

- Submit Your Formal Application: This is where you provide all the necessary documentation. The lender will then conduct a formal assessment, including a property valuation.

- Loan Offer and Acceptance: If your application is approved, you’ll receive a formal loan offer. You’ll need to review this carefully, paying attention to the interest rate, fees, and terms, before signing.

- Settlement: Once everything is in order, the loan will settle, and you’ll be on your way to owning your new home.

Remember, seeking advice from a mortgage broker can be incredibly beneficial during this stage. They can help streamline the process, compare multiple lenders, and potentially find you a more competitive deal, saving you time and money.

It’s also worth noting that the specific requirements and timelines can vary between lenders, so always check with your chosen institution for the most accurate information regarding their application process.

Wrapping Up Your Home Loan Choice

So, you’ve looked at the different kinds of home loans available in Australia. It can seem like a lot to take in, right? Most people will likely end up with a standard owner-occupier loan, paying off both the main amount and the interest. Deciding between a fixed or variable rate really comes down to what you prefer – a bit more certainty with your payments, or the flexibility to change things if rates move. If your situation is a bit different, like buying to rent out or building a place, there are other options too. Don’t feel like you have to figure it all out alone. Talking to a mortgage broker can really help clear things up and point you in the right direction for your specific needs.

Frequently Asked Questions

What’s the most common home loan for people buying a place to live in?

Most Australians buying a home to live in will get an owner-occupier loan that helps them pay back both the main amount borrowed and the interest. If you’re buying a property to rent out, you’ll need an investor loan, which usually has slightly higher interest rates.

Should I choose a fixed or variable interest rate?

A variable rate can go up or down, meaning your payments might change. A fixed rate stays the same for a set time, giving you predictable payments. Many people choose a fixed rate for a few years for stability, then switch to a variable rate.

What’s the difference between paying off principal and interest versus just interest?

When you pay principal and interest, each payment reduces the amount you owe and the interest. If you only pay interest, your payments are lower at first, but you’ll still need to pay back the main amount later, which can cost more overall.

Are there loans for people who aren’t employed full-time?

Yes, there are ‘low-doc’ loans for people who are self-employed or can’t easily show regular income. Also know as easy approval home loans. You might need to provide different proof of your earnings, like a letter from your accountant. These loans can sometimes have higher interest rates.

What is an offset account?

An offset account is linked to your home loan. Any money you have in this account reduces the amount of interest you’re charged on your loan, without you actually making extra loan payments. It’s a great way to save money on interest, but it’s usually only available with variable rate loans.

What if I want some stability but also flexibility with my home loan?

You could consider a ‘split loan’. This lets you fix the interest rate on one part of your loan for predictable payments, while keeping the other part on a variable rate for flexibility. It’s like getting the best of both worlds!